Key findings

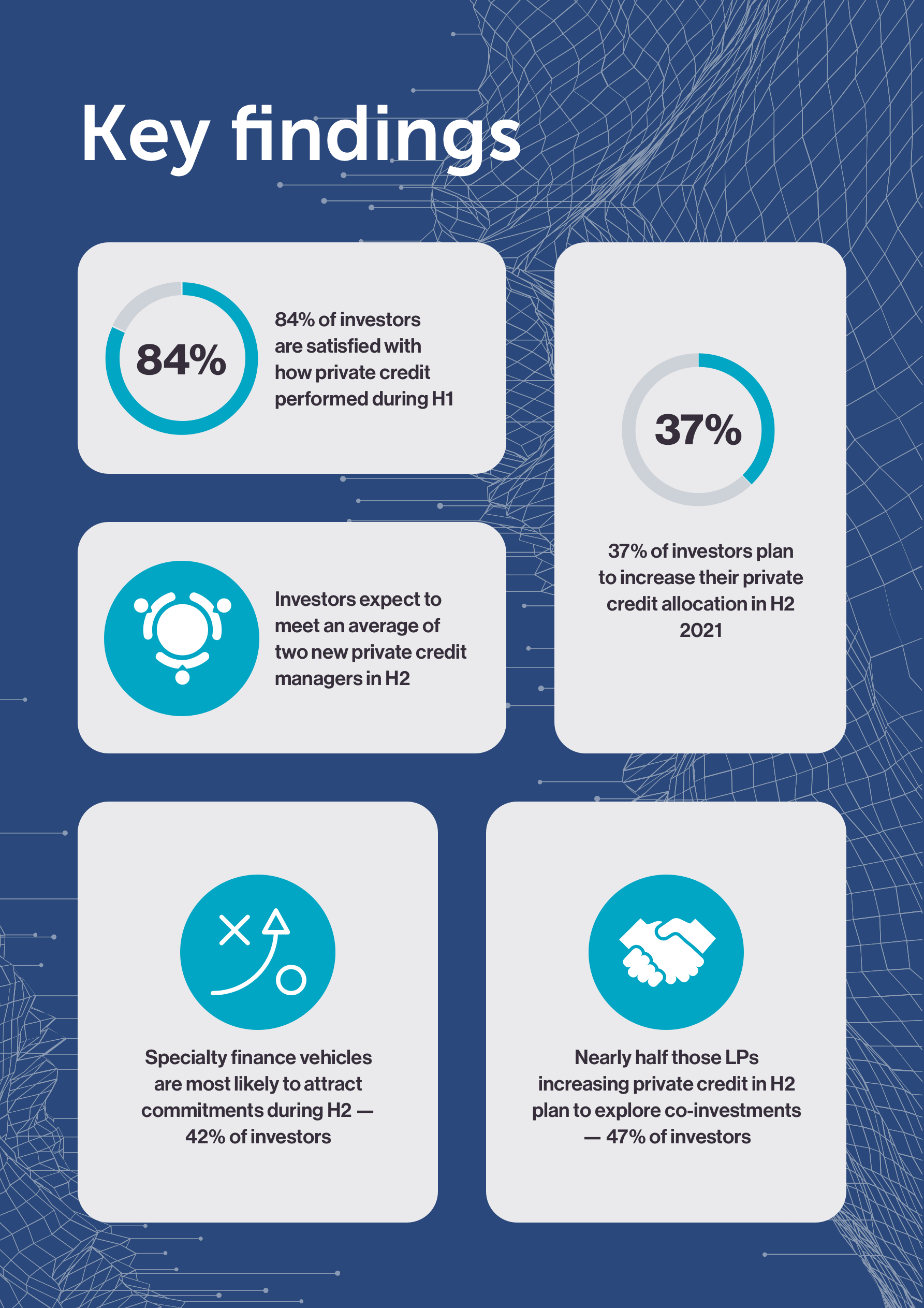

Over one-third of LPs plan to increase their allocation to private credit in the second half of 2021, as the industry continues to successfully navigate the effects of COVID-19 on the global economy.

Based on surveys and interviews conducted with 108 investors in alternatives during Q2 2021, Investor Intentions H2 2021 provides private credit fund managers and investors with critical intelligence on the plans and sentiment of their peers in the second half of the year.

Satisfaction with private credit remains high (84%), albeit having fallen slightly since we conducted our last survey six months ago. With monetary and fiscal support having continued for longer than expected and preventing a wave of bankruptcies, we attribute this to mild concern over some of the newly raised distressed funds.

Satisfaction was high across investor types. Even among private wealth, the lowest-ranked group, 74% were happy with private credit in H1. And of those family offices planning to increase their allocation, 40% said that reaching target was their principal reason for doing so. At first glance, this may seem banal, but in our view, this speaks to the formalisation of private wealth LPs approach to the asset class.

And when it comes to target allocations the picture for the industry is bright. 26% of investors are below target, against just 10% above, indicating that there remains considerable scope for growth, particularly among large institutional allocators.

Speciality finance strategies as well as more common direct lending funds can expect to see the strongest commitment activity in the second half of 2021. Also of particular interest to investors are bespoke products, such as separately managed account and co-investment vehicles, with nearly three-quarters of those increasing their allocation planning to explore one or the other.

Elsewhere, investors are moving out of cash and long-only fixed income, but this capital is more likely to find its way into alternatives than long-only equities, which our data suggests may be nearing their peak.

All in all, performance during the past 15 months has allayed investor reservations, particularly among those of a more cautious bent. This has accelerated a shift towards greater private credit allocations and means private credit managers retain considerable scope for growth as they look to H2 2021 and beyond.

-

Tom Kehoe

Managing Director, Global Head of Research and Communications

-

James Sivyer

Head of Investor Research, PCFI

About the research

Thanks to our participants

On behalf of PCFI and ACC, we would like to thank everyone that participated in the survey and shared their insights.

Download report

Investor Intentions H2 2021 - Private Credit Fund Intelligence is available to members and non-members of ACC. For more information about the report, please contact AIMA’s Global Head of Research and Communications, Tom Kehoe ([email protected])