Background

The industry-led Productive Finance Working Group (PFWG) was specifically established to develop practical solutions to the barriers investing in less liquid assets, focusing mainly on barriers faced by DC pension schemes.

The PFWG is co-sponsored by:

- John Glen MP, the Economic Secretary to the Treasury;

- Andrew Bailey, Governor of the Bank; and

- Nikhil Rathi, Chief Executive of the FCA

The PFWG is made up of a diverse set of market participants, including but not limited to banks, asset management firms, pension funds and insurance companies, corporates, infrastructure firms, wealth managers, investment platforms and trade associations representing relevant sectors and markets.

AIMA’s role

Report Recommendations

RECOMMENDATION 1: Shifting the focus to long-term value for DC pension scheme members

DC pension schemes are primarily focused on cost, which the larger schemes currently compete for business on. This reduces the attractiveness of investment in less liquid assets (which often bear greater costs), even if they present the opportunity to create greater value for their members. As such, there is a need to shift the focus from cost to long-term value and enhanced outcomes for DC scheme members. To achieve this, we recommend the following.

a. DC scheme trustees are the ultimate decision maker on investment for most of their members and need to focus on long-term value for them.2 Where appropriate and in their members’ interests, trustees should actively consider how increasing investment in less liquid assets (including through newly created LTAFs) could generate greater value for their members, and monitor long-term returns using robust metrics.

b. Consultants play a key role in supporting DC schemes in making investment decisions. Consultants should therefore:

(i) endorse the objectives of this work; and

(ii) integrate allocations to less liquid assets in their recommendations to their DC scheme clients, when appropriate.

c. Recognising the challenges associated with investing in less liquid assets, trade bodies should further raise awareness of the benefits and operational considerations of investment in less liquid assets, including on how to manage the risks.

d. To support DC schemes’ investment in less liquid assets – particularly, mid-range schemes which do not have significant bargaining power – the legal profession, asset managers, DC schemes and investment consultants to work together in the appropriate forum to consider:

(i) appropriate methodologies to accommodate performance fees within the charge cap; and

(ii) appropriate terms and conditions, more generally.

Industry should engage with the official sector on the results of their work.

e. The charge cap plays an important role in protecting pension scheme members, but can also risk contributing to a focus on cost over value. As DC schemes consolidate and the industry builds scale, DWP should:

(i) continue to monitor the overall impact of the charge cap;

(ii) continue to consider how to reconcile performance remuneration (that may be associated with greater overall value for members) and the charge cap rules and;

(iii) confirm that transitional arrangements would be considered if the charge cap were to change.

f. To shift the focus from cost to value and make an impact that is only possible through collective action, DWP and TPR should consider ways to proactively communicate their supportive messaging on investment in less liquid assets, as they have in this report (e.g., publishing additional guidance for trustees on investing in less liquid assets).

RECOMMENDATION 2: Building scale in the DC market

Investment in less liquid assets often requires expertise and knowledge that would typically only be available to larger DC pension schemes. It is therefore important to encourage greater levels of DC pension scheme consolidation in the market to support a shift of focus to value, and to provide greater opportunity to invest in less liquid assets. To help achieve this, we recommend the following.

a. A lack of scale is a key barrier for DC schemes in investing in less liquid assets. Increasing scale is likely to facilitate greater investment in such assets, for example, by raising schemes’ bargaining power in relation to their fees and their ability to draw on the relevant expertise in making such investments. To address the barriers from the lack of scale in the long tail of smaller DC schemes, DWP should continue with a DC schemes consolidation agenda, where it is clear that schemes are not providing value for members.

b. DC scheme trustees to assess their scheme’s ability to deliver value and access a diversified range of asset classes at its current scale in their consideration of whether to consolidate.

RECOMMENDATION 3: A new approach to liquidity management

DC schemes have liquidity needs that are driven by their members’ needs. Most DC schemes currently invest predominantly in daily-dealing funds. This means that, in theory, all their holdings can be sold at short notice to realise cash, thereby allowing them to meet members’ needs. Investments in less liquid assets usually do not present the same redemption opportunities, and, as such, careful consideration will need to be given to appropriate liquidity management at the DC scheme and underlying fund level. We recommend the following.

a. To support appropriate liquidity management at DC scheme level and give trustees greater confidence in investing in less liquid assets without putting at risk their obligations to their members, DC schemes will need support and guidance at a fund level. Industry participants and trade bodies should develop guidance on good practice on a toolkit for liquidity management at a fund level, in consultation with the FCA and Bank of England in the context of their broader work on liquidity classification for open-ended funds. This guidance should focus on appropriate ranges for dealing frequency and notice periods for different asset types.

b. Drawing on this guidance, asset managers should develop products, including LTAFs, that suit DC schemes’ needs and give trustees greater confidence in investing in less liquid assets.

c. The FCA should support this by providing information to trustees about how asset managers are required to price units, in particular in an LTAF context.

RECOMMENDATION 4: Widening access to less liquid assets

There are currently various ways in which investors can access less liquid assets, including through closed-ended funds and investment trusts. That said, there is an opportunity to increase the range of available products, including open-ended, FCAauthorised vehicles, which might appeal to those investors that do not currently invest in less liquid assets. We recommend a series of actions to support the distribution of less liquid assets, including through the LTAF, to a broader range of investors including DC schemes and retail investors, where appropriate.

a. The FCA to consult on removing the 35% cap on investment in illiquid assets for all permitted links, where the underlying investor is not self-selecting their investments.

b. The FCA to review the application of the Financial Promotion rules to the LTAF, including the classification of the LTAF as a non-mainstream pooled investment (NMPI), once LTAFs are established. In addition, the FCA to consider further the appropriateness of applying this framework to the LTAF as part of its review of the potential safe distribution to retail investors more broadly. Where the FCA considers that changes to its rules might be appropriate, it should follow its usual public consultation process.

2 Throughout the report we use the term ‘trustees’ to refer to a broader range of DC scheme decision-makers, also including insurance companies’ in-house investment teams and Independent Governance Committees

Next steps

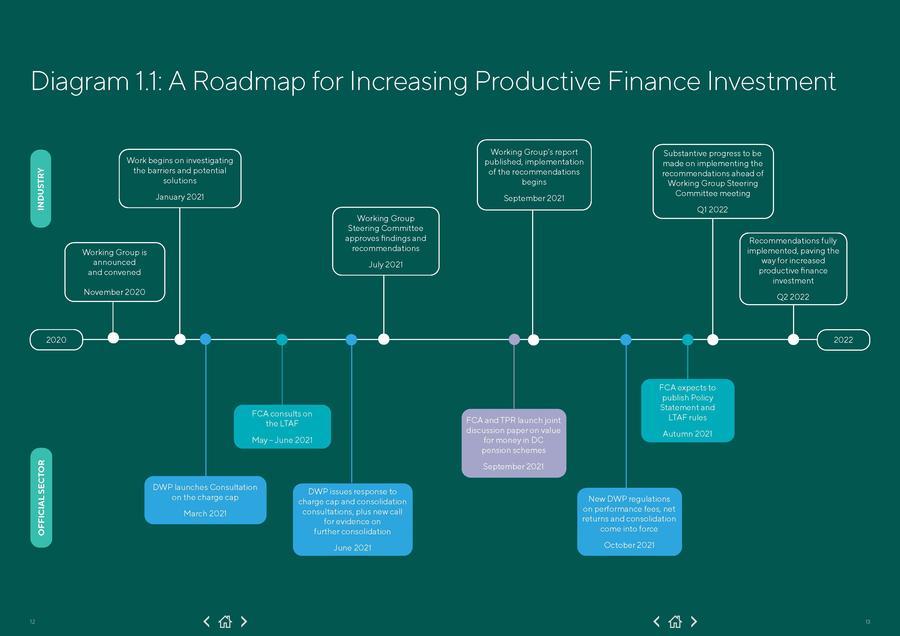

AIMA, other members of the PFWG and industry stakeholders will now work to implement these recommendations. The diagram below provides a timeline of key implementation milestones:

LTAF illustrative examples

This box summarises some of the hypothetical examples, developed by the Working Group to explore potential features of LTAFs.

| Sustainable Infrastructure LTAF | SME Private Credit LTAF | Multi Asset Fund | |

|---|---|---|---|

| Strategy | Focuses on infrastructure assets that accelerate the transition to a net zero economy | Making and purchasing loans to SME businesses in the UK | A portfolio of diversified assets by asset class, type and geography to give investors access to private markets |

| Asset Class | At least 70% direct unlisted infrastructure equity |

At least 50% direct unlisted loans Reaming in listed credit securities |

30-50% Private Equity 20-50% Direct Lending (Private Debt) 0-20% Equipment Financing (Real Assets) |

| Geography | UK & European Union | UK only | Global |

| Expected holding period for client | 15 years | 3-7 years | 5-10 years |

| Dealing |

Commitment model – i.e. client monies are drawn down by manager when required to purchase an asset |

Subscription model i.e. all monies are accepted by the fund at the dealing point Quarterly redemptions Monthly subscriptions |

Subscription model i.e. all monies are accepted by the fund at the dealing point Quarterly redemptions Quarterly subscriptions |

| Initial Lock in period | 5-year initial lock-in period | 24 months | 3 years |

| Notice Period for redemptions | 24 months | 6 months | 6 months |