What does it take for emerging managers to succeed in today’s high-stakes environment?

By Lawrence Obertelli, Marex Prime Services

Published: 18 November 2024

In recent years, market volatility and mounting pressures have profoundly impacted most industries, and alternative investment managers are no exception. Investors are more selective, seeking managers who not only deliver risk-adjusted returns but also show agility, operational proficiency and transparency.

Staying ahead takes more than strategy—it requires adapting to these trends and anticipating what’s next. For emerging hedge fund managers, who often operate with lean resources, the stakes are even higher. So, how are they navigating these complexities while continuing to attract capital and grow?

Marex’s latest research report, “Standing Strong: Emerging Manager Survey 2024,” co-authored with the Alternative Investment Management Association (AIMA), dives into the strategies that are helping these managers stay competitive, from cost control to operational efficiency, revealing how they are positioning themselves to thrive in today’s market.

This edition is the fourth report produced over the past seven years by Marex Prime Services (formerly Cowen Prime Brokerage) and AIMA on emerging managers – those managing up to US$500m. The report is unique in its depth and continuity of data, enabling emerging managers to gain unparalleled insights into the unique challenges and opportunities they face. It also sheds light on investor interests and concerns in this segment of alternative investments.

This year’s theme, ‘Standing Strong’, highlights how emerging hedge fund managers are navigating a challenging environment. They are showing resilience by balancing various factors, such as competitive fee models and lean operating practices, which helps them stay appealing despite economic and market pressures. By focusing on costs and efficiencies, smaller and emerging hedge funds are able to succeed in a challenging economic climate.

A focus on operational efficiency: Doing more with less

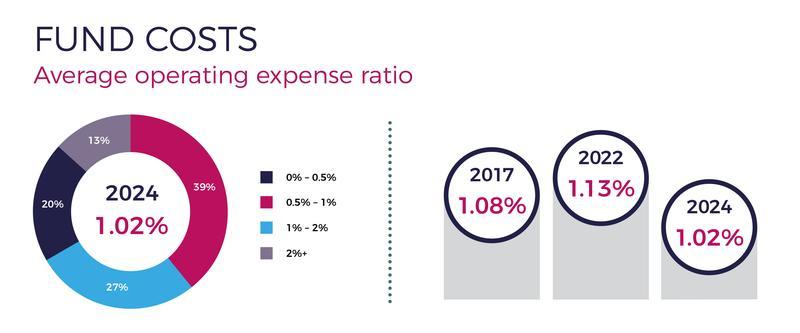

The research highlights the sustained impact of COVID-era operational practices and efficiencies. Against a macroeconomic backdrop of rising costs, emerging hedge funds have kept operating expenses and breakeven costs below pre-pandemic levels. The findings also underscore the significance of outsourcing, enabling managers to control costs while leveraging specialist expertise and scalability.

According to the research, managers are offering fees significantly lower than the traditional 2&20 model, making their funds more attractive. This is consistent with the broader industry move towards greater alignment of interests. It reinforces the message that competitive fee structures are crucial to attracting investors for emerging hedge funds.

Emerging manager fees have been stable at these competitive levels for many years, with management fees averaging at 1.37% and performance fees at 16.36%. Furthermore, Managed Accounts, with their own fee terms, are becoming increasingly popular. Emerging managers can be more nimble and amenable to bespoke opportunities, meaning they potentially stand to benefit from this trend more than their larger counterparts.

Emerging funds attract investor interest

Despite higher global costs and persistent pressure on fees, emerging funds continue to stand strong, attract investors and adeptly manage expenses to stay ahead. According to the research findings, there are a number of reasons why fund managers should be optimistic about investor interest.

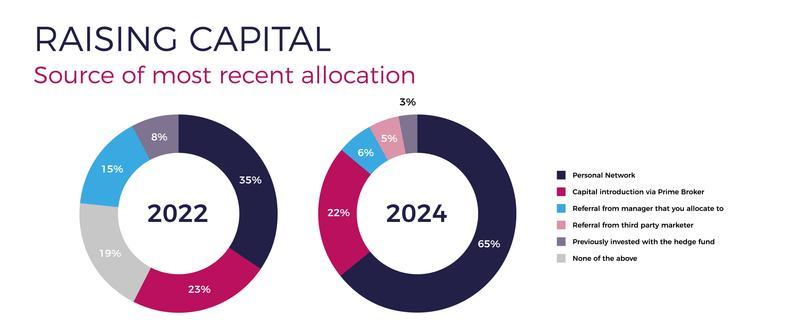

- Investor behaviour: Investors continue to show interest in funds with a track record of one year or less, with 48% selecting this option, in line with previous reports. More than 75% of investors rely on their personal networks or prime broker capital introduction teams to source new hedge fund managers.

- Strong interest in smaller funds: Two-thirds of investors surveyed are still open to allocating to emerging managers with less than US$100 million in assets under management (AUM), a welcome counterpoint to the industry’s bifurcation trend.

- Track record requirements: Half of the investors surveyed said they would consider allocating to an emerging manager with a track record of less than a year.

It is worth noting that investors also expect more from their managers regarding transparency and communications before making an allocation. The average time to close on new investments has increased from six to eight months since 2022, with investors taking a more sophisticated approach to due diligence, making emerging managers work harder to secure new tickets.

Meaningful insight

The research has been conducted to help both fund managers and investors make informed decisions and adapt to the evolving market. The time series analysis reveals long-term trends, while cross-sectional analysis provides detailed insights into variations across fund types, sizes and regions.

The report provides a nuanced understanding of the resilience and adaptability of emerging hedge fund managers. It is very encouraging to see how emerging managers are standing strong and attracting investor interest amid the fiercest of fee environments and increasing costs.

About ‘Standing Strong: Emerging Manager Survey 2024’

The research findings are derived from two surveys: one of managers running funds of up to US$500 million AUM (171 respondents) and the other from investors that allocate to this segment, (60 respondents, with an estimated aggregate AUM of US$400 billion). Data has been gathered on hedge funds running between US$500m-US$1bn AUM, which is presented for comparison purposes to act as a roadmap to scaling.

Hedge fund manager survey respondents in this year’s survey had an estimated aggregate AUM of US$18.3bn and an average AUM per manager of US$107m. This research amongst fund managers and investors was carried out in H1 2024.

Similar to prior reports, the data has been broken down by region and investment strategy in some areas to provide a more granular analysis of how trends differ within the pool of survey respondents.

To download a copy of the report, please visit this link.