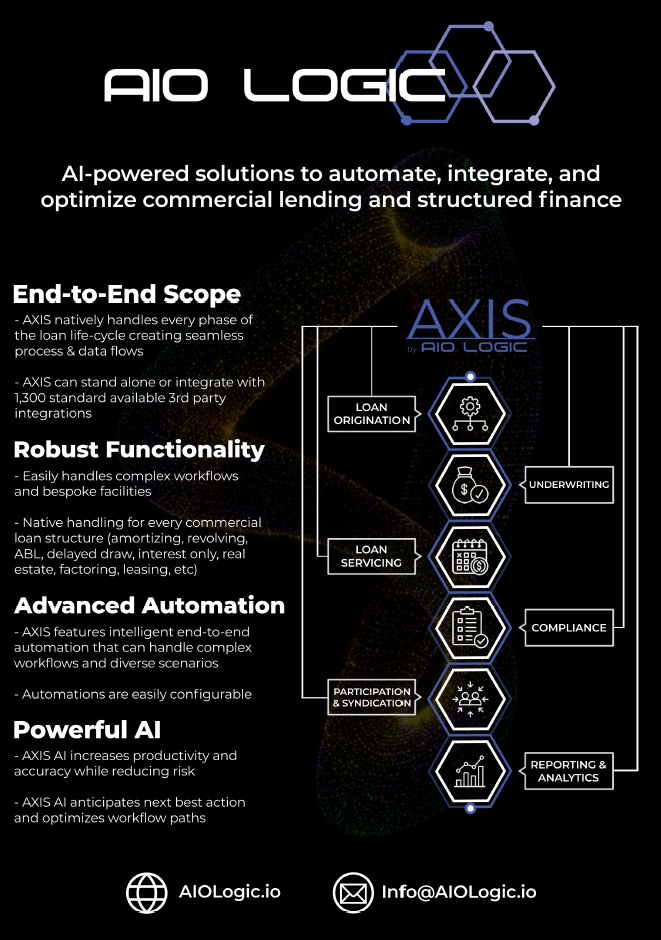

Understanding AI and specific applications to commercial lending & structured finance

By George Souri, AIO Logic

Published: 23 September 2024

The rise of artificial intelligence (AI) has been one of the top stories in both the technology and business sectors over the past couple of years. The wide-ranging intrigue of AI can be attributed to its potential application in so many industries and unique situations. Executives seeking to achieve certain business goals, view AI and automation as a way to help their firm achieve those goals at levels that would not otherwise be possible.

While most of today’s business executives have a general understanding of AI, their definitions are often either too broad or too narrow. In short, AI operates as a digital brain that can gather information, apply reasoning, infer conclusions, and make decisions. Essentially, AI is the ‘thinking’ aspect of automation that takes in information, decides on the correct process, and issues an action command. Once that command has been issued, automation is then used to perform the action and complete the task.

The challenge facing commercial lending

Generally speaking, industries with a higher level of complexity in their workflows have the potential to accrue greater benefit from implementing AI. The more complex the workflow, the greater impact that can be achieved by automating tasks in that workflow. Therefore, firms in the commercial lending and structured finance industry are prime examples of precisely who should be considering the implementation of AI.

Currently, the vast majority of commercial lending firms do not have technology that provides the level of functionality they need to operate effectively and efficiently. As a result, these commercial lending firms are burdened with time-consuming and error-prone manual processes, disparate systems that are both costly and inefficient, and data silos that make it difficult to perform insightful data analysis. Taken together, this leads to increased costs, increased risk, data fragmentation, data errors, and process errors.

This lack of sufficient technology presents real challenges to commercial lenders throughout the entire loan lifecycle, ranging from deal sourcing and deal management to loan origination and loan servicing. As a complex transaction lifecycle that is made up of several sub-processes, the loan lifecycle presents many complex workflows that can be difficult and inefficient if performed manually. Thankfully, AI and automation can help lenders streamline these workflows, allowing them to increase efficiency, reduce costs, and reduce errors.

How AI provides the solution

The level of complexity in the commercial lending industry allows for some very powerful applications where AI and automation can provide solutions to the challenges outlined above. In each case, AI plays a key role in building intelligent automations that can deal with the complexity of the commercial lending industry. The applications of AI to the commercial lending industry range across the entire loan lifecycle and vary in the level of benefit that they can provide the lending firm.

For example, some areas of the loan lifecycle where applications of AI provide particularly high benefits to commercial lenders include loan origination, financial analysis, risk monitoring, and reporting & analytics.

In the loan origination process, AI can automate the initial screening and validation of loan applications, reducing the time and effort required for manual processing. This increases efficiency which leads to reduced costs, while also reducing the likelihood of error. Additionally, the customer experience is also enhanced thanks to the quicker origination timeline.

Relating to financial analysis, AI can rigorously analyse vast amounts of data quickly and accurately to automate real-time underwriting and borrower financial health monitoring. Instead of relying on analysis and decision-making of humans, firms can base decisions regarding creditworthiness on real-time analysis performed by powerful AI. This allows lending firms to make insightful decisions on potential investment opportunities, thus mitigating credit risk.

An area where AI has particularly powerful applications is risk monitoring. In this area, AI can predict potential risks and vulnerabilities in business processes, allowing organizations to mitigate them proactively. Specifically, AI can identify patterns and risk factors in financial, collateral, and loan data to proactively manage risk by identifying early warning signs. These capabilities combine to mitigate both process risk and default risk, which are key hurdles for lenders to overcome.

In an industry that is so reliant on analytics to make informed decisions regarding future investments, AI can be especially powerful in the area of reporting and analytics. For example, AI can provide real-time insights into operational performance, enabling firms to monitor key metrics and KPIs continuously. Additionally, AI can automate the generation of reports, providing accurate and timely information to stakeholders.

While there are many other potential applications of AI in the commercial loan lifecycle, these were just a few examples of the powerful ways in which AI can be applied to the commercial lending industry. In a complex and competitive industry such as the commercial lending industry, AI can be deployed as an extremely powerful tool to help firms achieve their business goals. The technology exists to solve the challenges that firms face, now it’s just a matter of those firms implementing the powerful AI technology available.

Ready for your future?

For a majority of commercial lending firms, their current processes and technology are not optimal, leading to missed opportunities and competitive disadvantages. As they seek ways to improve processes and turn those disadvantages into advantages, implementing new technology will often be in the front of mind. While technological changes can be difficult to implement, especially in larger firms, the time is now to prepare your firm for a future that will undoubtedly feature heavy use of AI in commercial lending.

As the commercial lending industry continues to become more complex and competitive, the future benefit of implementing AI technology to automate your firm’s processes will become increasingly significant. The good news is that this technology is no longer exclusive to firms with the largest budget. If your firm is willing to embrace the implementation of AI, you will be positioned to be amongst those who will reap the rewards from it for years to come.

Visit AIO Logic (aiologic.io) for more information.