The tax alpha advantage: A competitive edge for fund managers

By Daniela Cohen, RSM US

Published: 17 June 2024

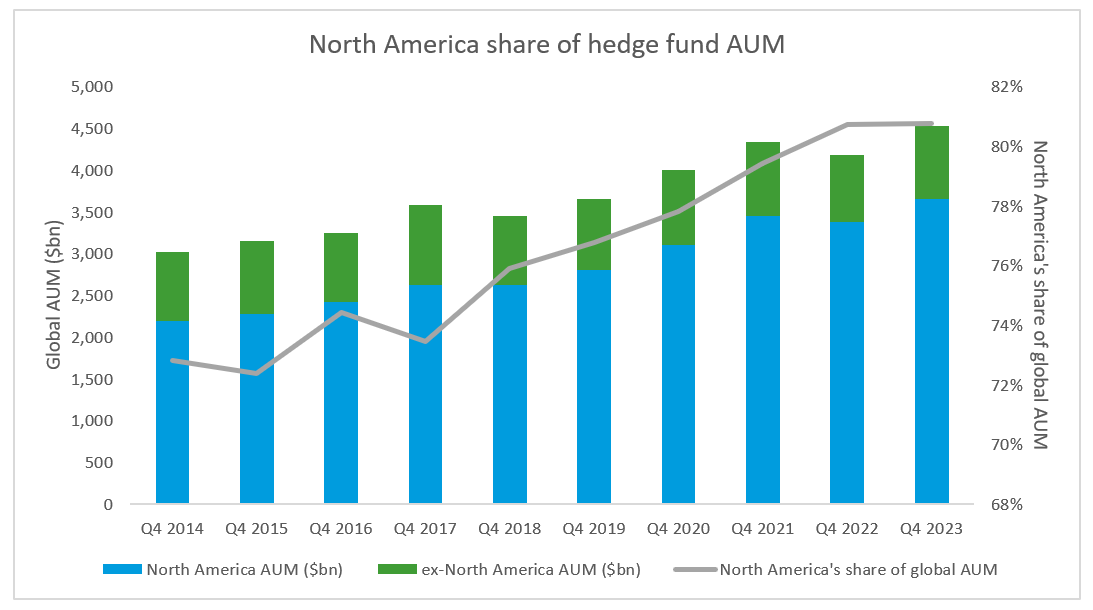

The asset management sector has experienced notable capital consolidation in recent years. Large managers continue to outcompete their smaller peers for capital as a result of economies of scale, technological advancements, regulatory pressures and changing investor preferences. Across all alternative asset classes, investors are committing more capital to fewer funds. Of the US$4.5 trillion in hedge fund assets under management at the end of Q4 2023, 80% of those assets, or US$3.7 trillion, were managed by North America-based funds, according to Preqin. This share has grown by about 7% since 2017 as the mega funds continued to gain market share, notably at the expense of European hedge funds whose share of global AUM has dwindled rapidly.

Looking to the future, the trend toward capital consolidation within this sector is likely to continue. Preqin’s latest Future of Alternatives 2028 report projects that hedge fund assets will grow 3.6% yearly, reaching US$5.2 trillion by 2028, with North America keeping a tight grasp on much of that AUM. Fund managers will need to focus on differentiating themselves to attract and retain capital and position themselves for success.

In this environment, the importance of tax-efficient investing is rising to the fore. Managing investments in a tax-efficient manner can enable fund managers to potentially enhance their investors’ after-tax returns and improve their overall return on investment. The key to effectively optimising tax alpha is the ability to access near-real-time insights to make better, quicker investment decisions.

Optimising tax alpha

The ability to optimise tax alpha can be a significant differentiator for fund managers in the competitive landscape of attracting capital. The impact of taxes on investment returns can be detrimental if not properly managed and planned for.

Too often, tax is viewed strictly as a compliance function. Tax departments are stretched thin by increasingly complex reporting requirements, higher expectations from investors, and outdated processes and technology. To become a value-creating function rather than a cost center, tax departments need to lean on automation and data analytics to provide enhanced insights.

The right technology can enable fund managers to effectively manage their tax compliance function and reporting obligations while also gaining insights to guide investment strategies and transactions. To do so successfully, there are certain features that fund managers should look for in potential technology solutions:

1. A single, integrated approach

With securities trading specifically, a single transaction may be subject to overlapping tax rules. This can make the analysis of all potential tax ramifications a bit challenging if traders are relying on manual processes to piece together their full tax picture. By using a single, integrated platform, portfolio managers can get a holistic look at the tax implications of their trades with a fully tax-sensitised view of the portfolio.

This clearer picture can enable fund managers to effectively analyse all tax implications of their trades, allowing them to more accurately plan for long-term capital gains and qualified dividend income, expedite or conserve short-term capital losses, and mitigate the potential for loss disallowances under the loss deferral rules.

2. Prioritisation of timely insights and modeling

Tax data is often provided after a trade has been executed, rendering it useless as a modeling tool. By leveraging advanced technology and the latest data, fund managers can rapidly analyse the tax consequences of various “what-if” trading scenarios. This includes assessing the impact of various trading strategies on the overall tax liability of the portfolio. Near-real-time modeling paves the way for identification of opportunities such as tax-loss harvesting and enhancement of the timing of trades to minimise tax exposure.

Timely modeling also allows fund managers to be more responsive to rapidly changing market conditions and investor needs. For example, if a geopolitical event or new policy initiative significantly affects an investment, managers can quickly assess the tax implications and adjust their portfolio accordingly. This level of agility is essential in today’s fast-paced and ever-changing operating landscape.

3. Synergy throughout the entire tax function

Employing systems that do not communicate with each other is a common barrier to effective automation within compliance functions. Having easy data flow between various functions in the asset management business is essential to automate certain processes. A fully integrated and transparent tax compliance system allows for seamless collaboration between various departments, including trading, operations, back-office and compliance teams. This can lead to improved efficiency overall, lower costs, and ultimately better returns for investors.

The long view

Tax considerations can be an essential part of the formula for an asset managers’ success. Those who prioritise tax efficiency and actively work to minimise the tax burden for their investors can provide significant value and help investors achieve superior long-term outcomes. As the importance of tax-efficient investing continues to grow, fund managers who can consistently generate tax alpha will be well-positioned to succeed in the competitive world of asset management.