The ‘ESG’ label

By William Bryant, NorthPeak Advisory

Published: 30 November 2021

Asset owner focus

The focus from asset owners on responsible investment continues to grow week by week. With each new industry survey, the requirement to consider responsible investment is increasingly important for an ever-growing number of investors, as beneficiaries and stakeholders look to make sure their investment activity fully incorporates societal views and expectations on a range of issues.

Almost all due diligence conversations that fund managers, including hedge funds, now have with allocators will at some stage come round to the topic of responsible investing, typically in the question – ‘How do you think about ESG?’.

Manager response

At NorthPeak Advisory we support fund managers with how to best incorporate environmental, social and governance (ESG) factors into their investment processes. Fund managers often express the desire for advice and support with becoming ‘ESG compliant’ or to create a version of an existing fund that can be labelled an ‘ESG fund’. This may stem from the belief that they can label a product and then raise capital from investors that have an ESG investment bucket.

In practice this can be problematic. The range of implementations expected by investors, as it relates to responsible investment, and the expectation of seeing ESG considerations be integrated into all investment decisions, as best they can, means that a one-size-fits-all label is not suitable. Labels can be relevant where there is a specific defined investment approach. This might be appropriate for an impact strategy or for a fund that focuses on a specific sustainability theme. However, the term ‘ESG’ now encompasses such a broad range of approaches that using it as a label can be confusing or even misleading.

The spectrum of responsible investment / ESG investing

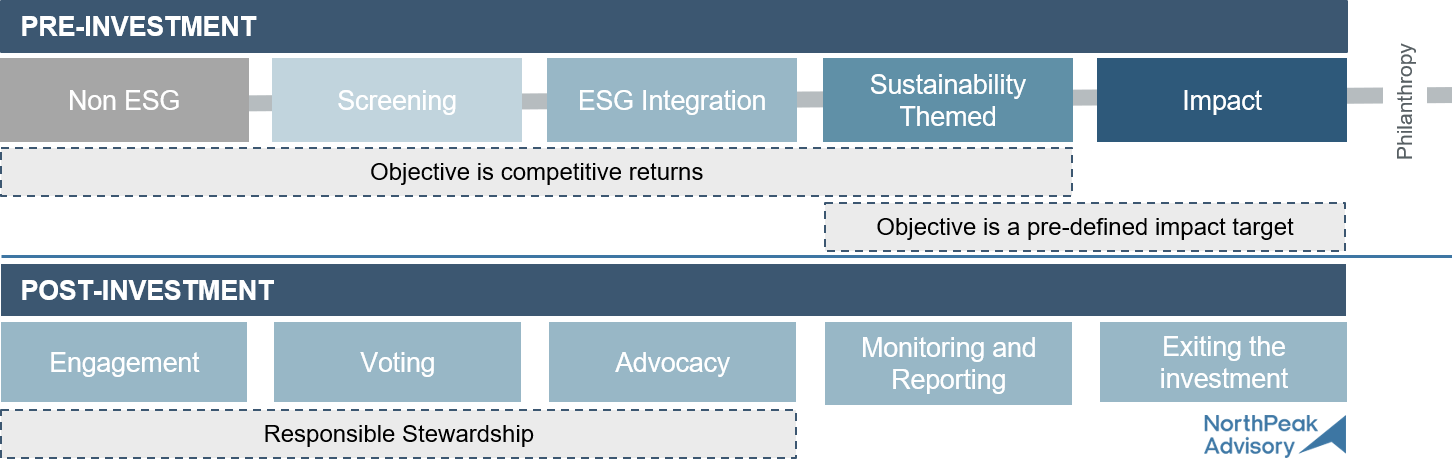

At this stage, it is probably worthwhile defining what responsible investing is. The UN supported Principles for Responsible Investment (PRI) define responsible investment as ‘a strategy and practice to incorporate ESG factors in the investment decisions and active ownership’. In practice, responsible investment is an umbrella term that can be used to describe a number of different approaches. These may include exclusions, positive screens, integration of ESG information, sustainability themed investments, and impact investing. Additionally, along with investment approaches and security selection, stewardship and ownership responsibilities can be included, even including support of well-functioning markets. There are a significant number of different ways to implement responsible investing, and often these are all captured by the supposed ESG label.

The definition of what is responsible investment from the asset owner perspective varies. For some it is about avoiding certain sectors, for others it is looking to have a significant positive impact on ESG issues with their investments, while others are more concerned with fully understanding all the risks that an investment is exposed to, including ESG risks. There is therefore diversity of opinion among investors as to how best to implement responsible investment. There is no one prescribed implementation approach that is ‘responsible investment’ or ‘ESG’, there are many approaches.

Differences of opinion

I remember a meeting at the PRI’s offices in 2010, during which the issue of short selling came up. In the conversation, two investors took completely opposite sides on shorting from a responsible investment perspective. One saying that profiting from shorting a company was against their responsible investment framework. While the other felt it was an appropriate way to articulate a view on a security when taking into account all information, including ESG related information. This divergence of view stemmed from different perspectives of how responsible investment should be implemented for those specific investors. Short selling is a topic that both AIMA and the PRI have published papers on, articulating the issues and the role that shorting can play within the context of responsible investing. More than a decade later there is rightfully still a lack of agreement around the topic due to different investor viewpoints. Ultimately, diversity in the execution of responsible investment within investment strategies as a whole exists because there is not one single approach.

At all levels of the investment process there are implementation differences, whether it is asset class, strategy, time period, turnover rate or region,and this is also true for responsible investment. Even when assessing a single company there is often significant difference of opinion when it comes to the ESG credentials of that company. This challenge has been widely discussed and is evidenced by the disagreement in ESG ratings across third-party data providers. These different judgments are then compounded when trying to assess ESG credentials within the context of financial performance. Whether an individual investment is strong from an ESG perspective is dependent on many factors, including the investment approach being taken. For example, is an investment in an oil producer an ‘ESG compliant’ investment? For some fund managers they may want to exclude this outright, for others engaging to influence future strategy and shift to renewables may make it attractive. Both can be described as a responsible investment or ESG strategy.

Not a product

As much as many fund managers would wish it to be so, ESG (as many now use the term) is not a product. A specific investment product may utilise a range of responsible investment techniques as part of the investment process. ESG information is another tool or lens through which the investment opportunity set can be assessed.

What investors are looking for

Understanding the ESG characteristics of a security can help fund managers comprehend the opportunities and risks that the security is exposed to in a more holistic manner.

While some hedge fund investors will no doubt want to see certain securities excluded from the investment universe to align with their views, a more widely accepted approach, is one of ESG integration. With an integrated approach, financially relevant ESG information on the security issuer is taken into account alongside other traditional financial analysis practices in order to inform the investment decision. Under an integrated approach ESG simply further informs the investment due diligence process.

In the majority of cases investors are looking for managers to elaborate how they include responsible investment approaches into their existing investment strategies. Typically they want to understand how the fund manager thinks about ESG impacting their investment decisions, how they go about collecting and integrating financially relevant ESG information, and how they monitor that information during the holding period of the investment; all of this in a systematic and repeatable process. Since there are numerous approaches that can be applied, and their relevance depends on the investment strategy at hand, trying to bucket all these differences under one ‘ESG label’ makes little sense.

The end of ESG

One thing that many of us who have been focused on ESG and responsible investment for some time agree upon, is that the discussion around ESG investing will eventually disappear. Instead, simply thinking about investments through an ESG lens will become part of routine investment due diligence along with other investment relevant factors.

Avoiding greenwashing

Both regulators and investors are focused on understanding the discrepancy between what managers are saying versus what is implemented in practice. Also, with investors placing ever more scrutiny on the ESG credentials of a manager, having a clear and accurate articulation of how responsible investment is implemented and the framework for integrating relevant ESG information into the investment process is going to help managers address the key question – ‘How do you think about ESG?’ and to avoid, the worst label: ‘greenwashing’.