Securities Financing Transaction Regulation (SFTR) – An overview of the key challenges

By Duncan Carpenter, Pirum Systems Limited

Published: 12 October 2018

Although the dust has barely settled from the implementation of MiFID II earlier this year, the regulatory requirements facing EU domiciled firms show no sign of abating. The Securities Finance Transaction Regulation (SFTR) first came into effect on 12 January 2016, however, with multiple EMIR rewrites, MiFID II, Brexit and GDPR stealing the headlines, it has only recently become a focus for much of the market.

The regulation is part of the EU’s approach to meet the objectives set out by the Financial Stability Board (FSB) aimed at increasing transparency post the financial crisis. Some of the obligations of SFTR regarding fund disclosures and collateral re-use have already been implemented since SFTR was first enacted. However, one of the main, and arguably most onerous, requirements is still to come. Article 4 requires in-scope market participants to report all SFTs to a registered Trade Repository (TR) on a T+1 basis. The SFTS in scope include repos, prime brokerage margin lending transactions, securities lending, buy/sell backs and commodities lending.

The SFTR reporting obligations apply to any counterparty to an SFT that is established in the EU (including their branches, wherever they are located) or any counterparty established outside the EU transacting SFTs through an EU branch.

Companies that need to report include:

- Investment firms and Credit institutions

- CCPs and CSDs

- UCITS, AIFMs, Insurance companies and Pension funds

- Corporates (NFCs)

To be clear, the reporting requirement applies to the principal counterparts in the trade. So in an agency lending structure, it is the fund rather than the agent lender who has the responsibility to report. It should be noted that for Alternative Investment Managers (AIFMs), it is the fund rather than the management company who is the in-scope counterparty of the transaction to report. Where a fund is in-scope, the responsibility to send the report under the regulation is passed to the AIFM.

Similarly, if a SFT takes place between a financial counterparty (FC) and a non-financial counterparty (NFC) then the FC is potentially obligated to perform delegated reporting on behalf of the NFC if the NFC meets certain criteria relating to their balance sheet, turnover and staffing numbers. Counterparties can also optionally choose to delegate the reporting exercise to other parties, but from a regulatory perspective the responsibility for the report remains with the in-scope counterparty.

There are a limited number of exemptions such as SFTs with EU member central banks, other Union public bodies managing public debt, or the Bank for International Settlements who do not need to report transactions under the SFTR, although these transactions would potentially need to be reported under MiFID as a result.

What are the main reporting requirements?

- SFTR is a two-sided reporting requirement, with both collateral provider (borrower) and collateral receiver (lender) required to report their side of the SFT to an approved TR on trade date +1 (T+1).

- All new SFTs, modifications of open SFT’s and terminations of existing SFTs must be reported daily.

- As part of the two-sided reporting obligation a Unique Transaction Identifier (UTI) must be included by participants in their reports to the TRs. This identifier will be used by the TRs to match separately received reports from each counterpart to an SFT.

- Participants must also use Legal Entity Identifiers (LEIs) to identify their counterparts along with many other parties involved in the SFT (e.g. Agent Lenders, CSD participants, CCPs)

- An extensive transaction, collateral, clearing and counterpart dataset needs to be reported which is up to 153 fields, depending on product and report type.

- A high number of matching fields (90+) combined with strict tolerances is likely to result in low matching rates post reporting. ESMA have provided a window of 24 months post implementation date to reconcile certain fields but the initial list is extensive and remains a significant challenge.

- For agency loans with multiple underlying principals, both borrower and lender will need to submit each allocation to a principal as an individually reportable transaction.

- SFTR reporting must also include any collateral linked to the SFTs including the LEI of the counterparty with whom the collateral was exchanged and the master agreement under which the transaction was agreed.

- Collateral is reported on T+1 or value date +1 (S+1) dependent on the method of collateralisation used.

- Collateral re-use must be reported daily at S+1 by the reporting entity and not the counterpart.

- Participants also need to keep records of any SFT for a minimum of five years following its termination.

The final draft of the Regulatory technical standards was released by the European Securities and Markets Authority (ESMA) on 31 March 2017, and have been under review from the European Commission (EC) for almost fifteen months. The EC officially commented in late July and had advised that the standards will be adopted once some minor changes have been drafted which rather than affecting the substance of the regulation, merely explain which body has the future power to change and adopt standards.

More recently, ESMA has responded indicating it would not make the changes proposed by the EC, which will likely result in some additional time as the two bodies come to a resolution on these remaining points. Allowing for those discussions and the subsequent adoption and approval process taking around four to five months, we expect the standards to enter into force some time during Q1 2019.

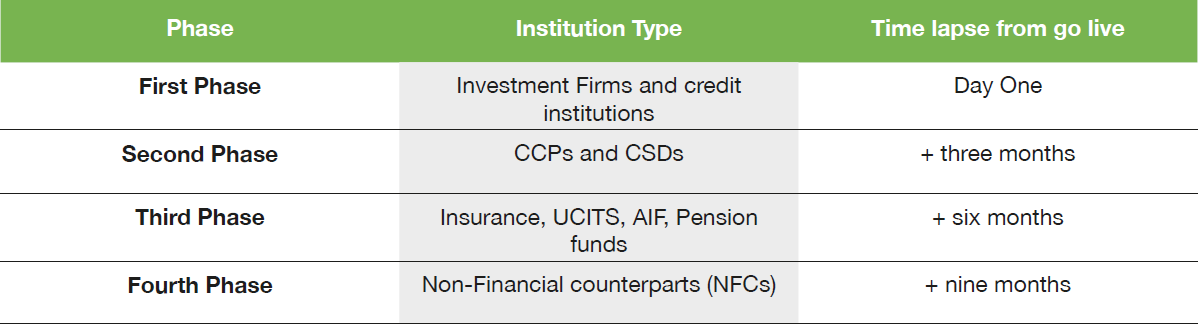

The first phase of reporting will come into effect 12 months after the Level 2 technical standards come into force, which would therefore result in a Q1 2020 go live date. The phased timeline is outlined below and, based on current expectations, this would mean that AIFM and UCITs management companies with funds established within the EU would have a go live data of Q3 2020.

Challenges

There are numerous challenges in meeting SFTR requirements including UTI generation, the reconciliation demands, enhancing your connectivity to the market, and the task of reporting and sharing information in a timely manner. In addition to this, the exercise of gathering the required data for a single report is a significant challenge in its own right.

The securities financing market is complex and disjointed in nature and typically there isn’t a single platform or source that holds a comprehensive view of all the data that needs to be reported. This is particularly relevant for AIFs and beneficial owners whereby their full set of data is often only stored on their prime brokers (PBs) or Agent Lender (AL) systems and not readily available to them to compose the report. This becomes more of an issue when you consider the daily life cycle events which must be captured, processed and reported also with a dependency on receiving timely feeds from their PBs and ALs.

Additionally, many of the 153 data fields included on the level 2 regulatory technical standards such as CFI codes, issuer credit ratings and LEI of issuer sit outside the scope of many of these platforms. Therefore, the data gathering exercise must include enrichment from externally sourced reference data and third parties, which adds to the challenge and the cost significantly.

Due to these difficulties, many firms are now looking to expedite the data roundup by leveraging existing industry data pipes and partnering with trusted third-party vendors.

Prime brokerage margin loans

In comparison to other asset types included in the regulation (stock loans, commodity loans, repos, buy/sell backs) which are reported per transaction, margin lending activity must be reported as an end of day position. Another notable difference is that each margin lending relationship between a prime broker and its client will be assigned a single UTI for reporting purposes. This is maintained for the lifetime of the relationship between both counterparts, whereas for other asset types a UTI is required for every reportable transaction. Reporting of the margin lending position will be required whenever there is a net negative cash balance, or a positive short market value at the relationship level.

The margin lending report includes both the details of the margin loan between PB and client in base currency, alongside a breakdown of any credits/debits in the underlying currencies. Details of the portfolio used by the PB to collateralise the margin loan also need to be reported by both PB and client (where in-scope). As PBs do not allocate specific collateral based on the current net exposure with a client this effectively means the full composition of the collateral portfolio needs to be reported whenever there is a margin lending reporting requirement.

Conclusion

As noted, for UCITS or AIF funds the management company is accountable for reporting. Firms should talk to their PB’s and service providers early, both to understand requirements and understand their approach. It should be noted that delegated reporting is permitted and potentially may be offered by PBs for in-scope clients. Third parties will often offer a modular solution whereby you can select a full end-to-end reporting service, or you could receive the prepared reports ready to send on to the chosen repository. It is vital to remember, however, that the regulatory obligation always remains with the counterparty to the trade. SFTR is a seismic challenge for all market participants and, with the deadline on the horizon, you must start preparing now.