Macro challenges endure in APAC, but investors see solutions in derisking

By Eric Chng, State Street

Published: 18 March 2024

Private market investors in Asia Pacific (APAC) are less optimistic than their European and North American counterparts about the macroeconomic prospects for their region.

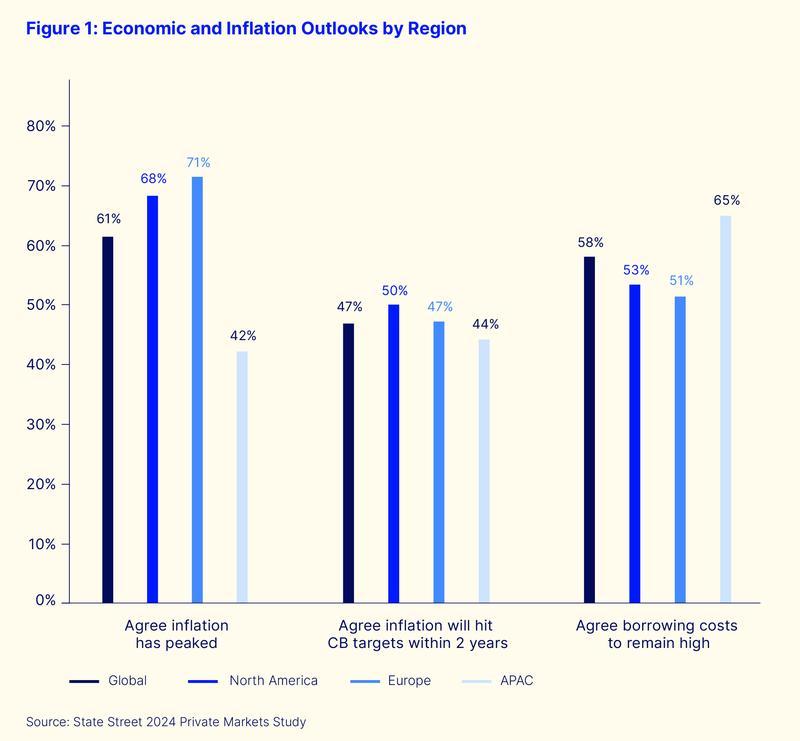

Fewer than half (42%) of APAC respondents to the State Street 2024 Private Markets Study said they thought inflation had peaked in their region, compared to more than two thirds (68%) in North America and nearly three quarters (71%) in Europe.

The study includes a survey of nearly 500 institutional investors globally, including multiasset managers, private markets managers, pension funds and insurance companies.

Last year’s research showed widespread global concern about the inflation and economic growth environment and its likely impact on investments across private equity, private debt, infrastructure and real estate, particularly in terms of high borrowing costs caused by central banks raising interest rates in response to inflation.

Findings from this year’s research suggest a somewhat diminished level of concern. Nonetheless, respondents still anticipate that the lasting repercussions of recent years’ low growth and high inflation will continue to influence private markets investment in the near to medium term.

However, clearer regional differences have started to appear in the data, when it comes to respondents’ views of the economic environment.

In addition to being less inclined to believe their local inflation has peaked than their peers, APAC respondents were also less likely to believe it would come back within their domestic central banks’ target levels within the next two years (see Figure 1 below).

Additionally, they were considerably more likely to agree with the proposition that borrowing costs would stay high and continue to negatively affect private markets investments.

Part of the reason for this distinction in outlook might be the diverse range of economies represented by the respondents from APAC, which differ in size and economic fundamentals.

Within the APAC region, jurisdictional differences pertain, with majorities in Japan, Singapore and China saying they did not believe inflation had peaked (in particular, only 10% of Chinese respondents believed it had), while at least half of Hong Kong, Australian and South Korean investors said inflation had peaked.

Despite this less optimistic perspective, the impact on deal flow has not been particularly different in APAC than in other regions.

As an example, 59% of APAC and European respondents said they had seen delays of at least three months in their deal pipeline as a result of the economic environment, with 56% of North American respondents saying the same. There was a slight tendency toward longer delays in Asia, but only involving small numbers – 5% of deals delayed by more than a year compared to 2% in Europe and zero in North America.

The ongoing fallout from recent economic conditions has lead, however, to some dominant global themes in firms’ reactions, which can be seen clearly in the APAC responses.

In particular, risk at the investment portfolio and operational level has become an increasingly significant area of focus for respondents to our survey.

Against a potentially higher-for-longer interest rates environment in the near term, the focus on underlying investments is critical to portfolio management.

Understanding the financials and debt levels at the underlying investments level is critical not only for ensuring portfolio valuations are justified, but more importantly to understanding how new investments can help diversify concentration risks.

“Justifying risky investments in a high-yield environment” was cited as the number-one contemporary challenge to private markets investment both worldwide (45%) and in Asia (51%). The biggest operational challenge was “risk measurement and management”, again for all respondents and in APAC, where 78% and 79%, respectively, put it in their top five challenges.

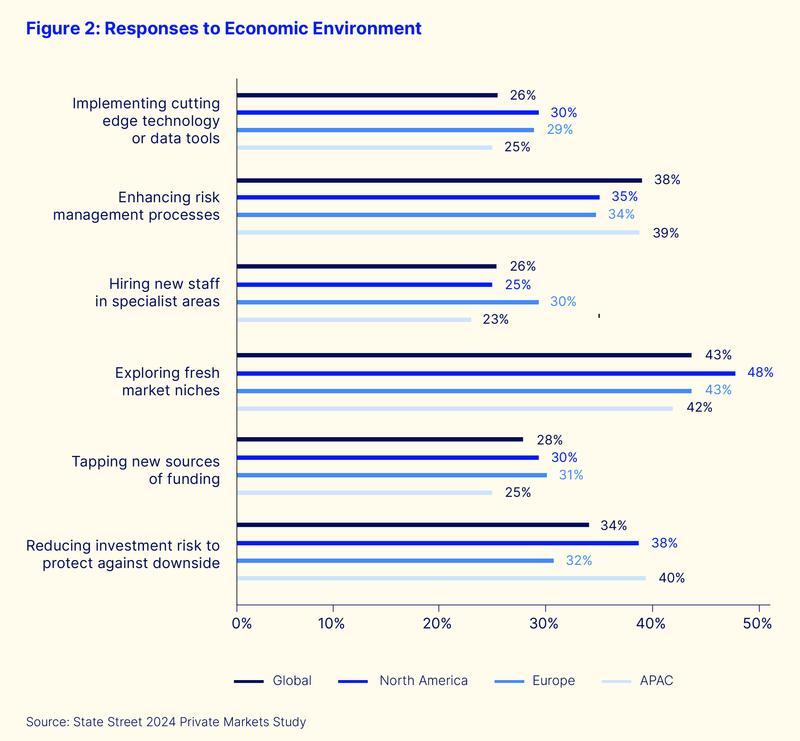

Unsurprisingly, “reducing investment risk” in portfolios and “enhancing risk management processes” were the first and third choices for APAC investors (and second and third globally) when asked what measures they were taking to mitigate the economic environment.

In this context, the second most popular choice in APAC (and first globally), “exploring fresh market niches” is key for investors as they seek to deploy capital into less crowded investments areas for diversification and to enhance returns.

However, in keeping with the findings of our 2023 study, a major challenge to investors in this space in meeting operational and investment goals like those outlined above, is data. 2024 respondents continued to cite challenges with the quality, timeliness and comparability of their data sources.

In APAC, 60% of respondents said they struggled with the accuracy of their valuations, 56% said frequency and timeliness were a major problem, and 47% pointed to difficulties seeing and analysing all their public and private markets positions together in a whole of portfolio view. Managing that having all portfolio data in one place was particularly important to Asian investors, with close to one third (32%) stating the ability to do so would be “transformational” for their private markets’ businesses, compared to approximately one quarter (26%) globally.

In their responses to these data challenges, institutions globally were increasingly interested in outsourcing their data management. Exactly one quarter of APAC respondents said they were “very likely” to do so in the next three to five years, compared to just 6% who have already done so. The results, however, also found that over half (57%) of respondents in APAC noted the cost of outsourcing was a serious impediment alongside 54% who expressed concerns about providers’ abilities to communicate with them effectively, after the initial handover.

It is clear from these results that institutions’ focus on portfolio risk and the operational solutions to managing it as a response to ongoing economic conditions present an opportunity to harness data for better decision-making and capital deployment. In APAC, where these challenges are still most strongly expressed, the ability for investors to look at outsourcing strategically and create a scalable and resilient operating model will give them a clear and distinct advantage to create better investment outcomes.

Look out for the first in a series of reports based on this research coming soon on StateStreet.com.

In APAC, 60% of respondents said they struggled with the accuracy of their valuations, 56% said frequency and timeliness were a major problem, and 47% pointed to difficulties seeing and analysing all their public and private markets positions together in a whole of portfolio view.