Integrating ESG risks into the corporate valuation process

By Ioannis Michopoulos, Stout

Published: 18 November 2024

Environmental, social, and governance (ESG) factors have emerged as critical risk drivers influencing companies’ financial performance and long-term viability. ESG considerations are no longer just ethical imperatives; they are essential components of comprehensive risk assessment and corporate valuation. Firms with strong ESG practices tend to enjoy a lower cost of capital, reduced financial risks, and enhanced investor confidence.

Ignoring ESG risks during the valuation process can lead to significant financial repercussions, including higher financing costs and potential reputational damage. Therefore, integrating ESG risks into the corporate valuation process is essential for making informed investment decisions, achieving accurate valuations, and ensuring sustainable business practices.

In this article, we present a robust framework for incorporating ESG premia into the valuation of corporate assets and discuss the financial implications of ESG risk for contingent-claims analysis and cost of capital assessment. The following discussion is based on the findings of our recently published paper “Measuring ESG Risk Premia with Contingent Claims” in The European Journal of Finance.

How do ESG factors affect the valuation of corporate assets?

ESG risks impact the valuation of corporate assets by influencing both the expected cash flows and the expected return on investment. Companies with poor ESG practices may face higher operating costs, regulatory fines, and reputational damage, which can significantly reduce the present value of future cash flows.

It is widely recognised in both the academic and industry communities that ESG risk is associated with higher levels of idiosyncratic and systemic risk.1 As a result, investors require higher discount rates to offset the additional risk that they bear.

Is ESG risk an economically significant pricing factor of asset returns?

To address this question, we examined the implied valuations of market participants in the equity and credit derivatives markets for the universe of S&P 500 companies from 2018 to 2023. By analysing publicly available data on stocks, credit default swaps (CDS), and physical default probabilities, we inferred the asset value dynamics, including long-term expected risk and return. Our findings indicate that greater exposure to ESG risk is priced into the market, resulting in a higher cost of capital and increased firm asset volatility.

How can we bifurcate the impact of ESG risk on the valuation of equity and debt securities?

To address this problem, we relied on the Black-Scholes-Merton option pricing model,2 which is the most widely used and accepted method for valuing equity securities in multi-share capital structures for financial and tax reporting purposes. Specifically, we developed a novel approach for estimating the ESG premium embedded in equity and debt values by incorporating various firm- specific and industry-specific variables into a tractable econometric model.

This approach allows us to statistically assess the impact of ESG risk on the cost of equity and cost of debt, and it is consistent with the company’s assumed capital structure and the economic rights and privileges of its securities upon the consummation of a liquidity event. The proposed bifurcation method relies on the foundations of contingent-claims analysis and is consistent with the observed market data.

What is the magnitude of equity and debt ESG premia for a representative firm?

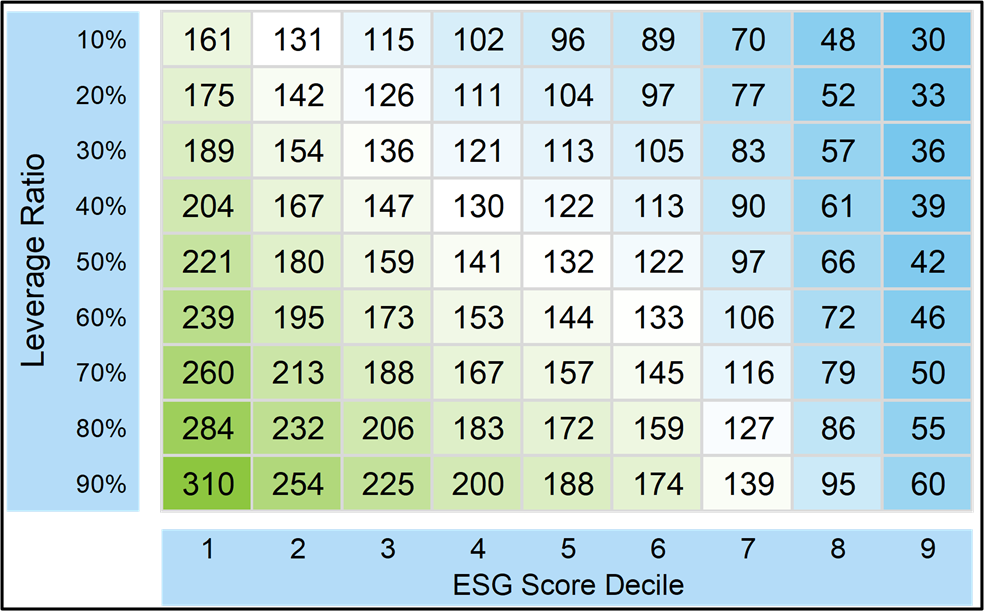

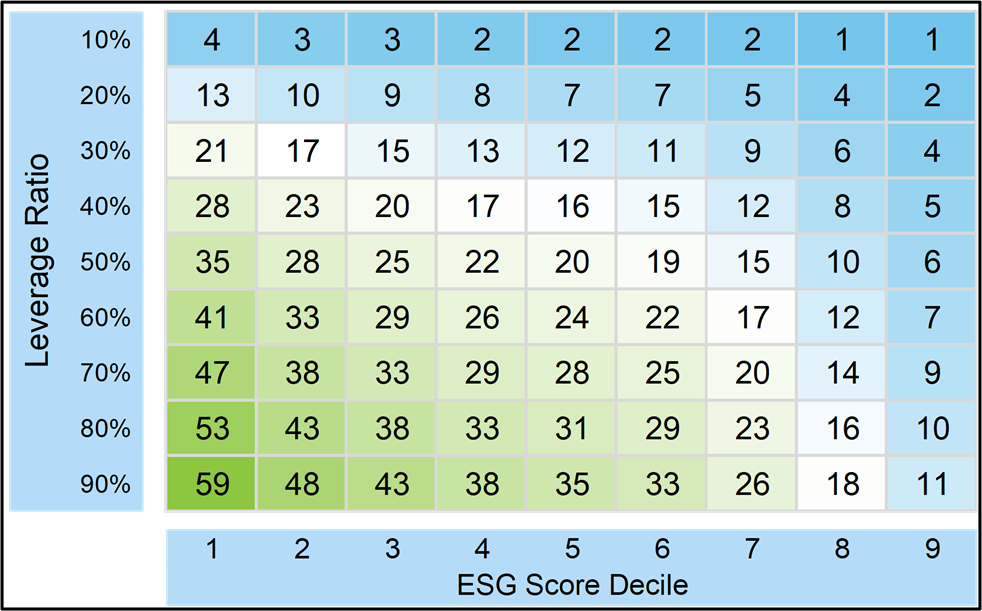

We calculated the ESG premia using the option pricing method, assessing various levels of indebtedness and ESG risk exposure. As outlined in the accompanying exhibit, we evaluated the equity and debt ESG premia by considering a representative industrial firm with a leverage ratio ranging from 10% to 90%, and an ESG score spanning from the first decile (ESG laggard) to the ninth decile (ESG leader) of the empirical ESG score distribution.

Our analysis suggests that equity ESG risk premia range from 0 to 310 basis points, while debt ESG risk premia vary between 0 and 59 basis points. Specifically, for a medium-leveraged firm positioned in the fifth decile of the ESG score distribution, the equity and debt ESG risk premia are 132 and 20 basis points, respectively. ESG risk premia increase with leverage and when firm’s ESG profile declines.

Figure 1: Equity ESG Premia (in basis points)

Figure 2: Debt ESG Premia (in basis points)

How should the cost of capital build-up be adjusted in the presence of ESG risk?

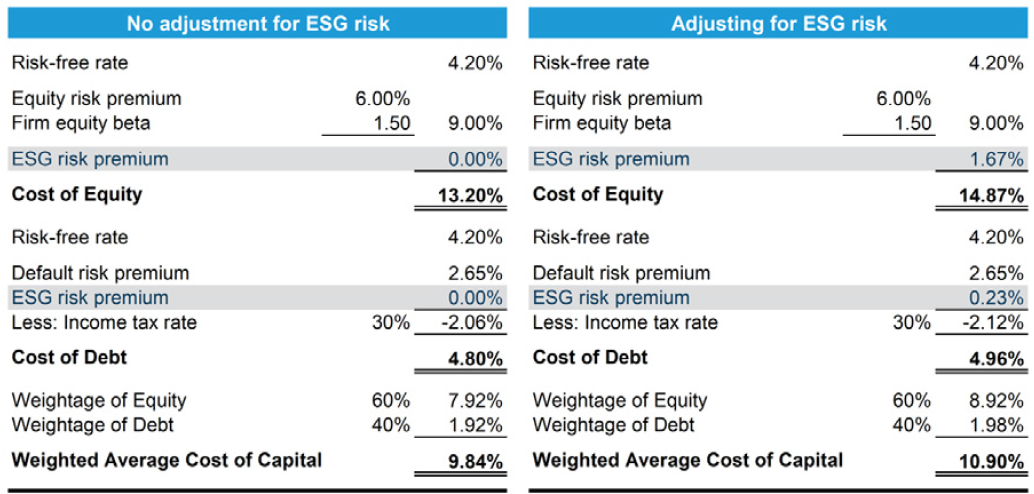

Our framework provides a transparent mechanism for adjusting the cost of capital for companies with any given capital structure and exposure to ESG risk. To illustrate this, we calculated the blended cost of capital for a hypothetical industrial firm with a leverage ratio of 40%.

For this exercise, we considered a firm positioned in the second decile of the ESG score distribution and calibrated all other inputs to match the market data applicable as of September 2024.

In the left panel, which shows the cost of capital build-up in the absence of ESG risk, we observe that the cost of equity and debt is 13.20% and 4.80%, respectively. The blended cost of capital is 9.84%. In the right panel, which shows the cost of capital build-up in the presence of ESG risk, we observe that the cost of equity and debt is 14.87% and 4.96%, respectively. The blended cost of capital is 10.90%.

Overall, we observe that ESG risk has a significant impact on the concluded cost of capital calculation, leading to a combined difference of approximately 106 basis points. This analysis underscores the importance of incorporating ESG considerations into financial models of corporate securities valuation.

Figure 3

1. Chava et al., 2014; Barth et al. 2022; Cao et al., 2022.

2. Black and Scholes, 1973; Merton, 1974

Alexandros Bougias also contributed to this article.

Other rerefences

• “ESG and Corporate Credit Spreads,” The Journal of Risk Finance, no. 2: 169-190, Barth, Florian, Benjamin Hübel, and Hendrik Scholz.

• “The Pricing of Options and Corporate Liabilities,” Journal of Political Economy, no. 3: 637-654, Black, Fischer, and Myron Scholes.

• “Unlocking ESG Premium from Options,” Swiss Finance Institute Research Paper, 21-39, J. Cao, J, A. Goyal, X. Zhan, and W. E. Zhang.

• “Environmental Externalities and Cost of Capital,” Management Science, no. 9: 2223-2247, Sudheer Chava.

• “On the Pricing of Corporate Debt: The Risk Structure of Interest Rates,” The Journal of Finance, no. 2: 449-470, Robert C. Merton.

• “Measuring ESG Risk Premia with Contingent Claims,” The European Journal of Finance, 1–24, Michopoulos et al.

Greater exposure to ESG risk is priced into the market, resulting in a higher cost of capital and increased firm asset volatility.