CSRD: A practical guide

By Harriet O’Brien; Daniella Woolf; Corinne Tomsett, Danesmead ESG

Published: 18 November 2024

Introduction

The Corporate Sustainability Reporting Directive (CSRD) is looming large for investors and corporates alike. It’s extensive in scope and content, requiring a preliminary double materiality assessment and a huge number of disclosures for each material ESG topic.

Many companies will need to start collecting sustainability data and beginning their double materiality assessment in fewer than 100 days.

So, what should companies do to prepare for CSRD?

This short guide outlines the key elements of the framework and practical steps companies need to take to prepare for CSRD reporting.

Scoping

CSRD will bring 50,000 companies into scope, expanding far beyond the original 11,000 affected by the previous corporate sustainability reporting, the Non-Financial Reporting Directive (NFRD).

CSRD will apply to EU companies as well as to international companies generating revenue from within the EU. Its scope includes public and private companies.

Introduction will be phased as follows:

- 2025: the first companies i.e. those already in scope for NFRD will need to publish their reports based on 2024 sustainability information.

- 2026: all other large EU companies (public and private) and other non-EU large companies listed on an EU regulated market will need to report using 2025 sustainability information.

- 2027: SMEs listed on an EU regulated market and EU small and non-complex credit institutions and captive insurance companies will need to report using 2026 sustainability information.

- 2029: Non-EU companies which generate €150m net turnover in the EU and meet certain other conditions will need to report using 2028 sustainability information.

Analysis to assess whether a company is in scope, and the level at which it will be required to report, can be complex. Its therefore important companies get advice and confirmation from their legal counsel.

Large organisations need to check whether they’re in scope as soon as possible so they can start to put in place processes to collect and report data by 2026.

2026 may seem quite far away but there’s a lot to do for companies in this cohort, especially if they are starting to collect sustainability data for the first time. Companies are strongly advised to make sure they allow enough time and start as soon as possible.

From our analysis, there are two groups in the asset management world that should pay attention here: 1) EU portfolio companies of private equity managers who are likely to be in scope in wave 2; and 2) certain investment managers who are structured with EU-based management company entities. Note that Funds themselves are not caught here (as they’re addressed by SFDR).

Double materiality assessment (DMA)

The double materiality assessment is at the heart of the CSRD. This approach combines two sustainability reporting concepts: financial materiality, sometimes known as the ‘outside-in’ approach, and impact materiality aka the ‘inside-out’ method.

A DMA means thinking about both how people and the environment impact a business AND how a business impacts people and the environment.

So, for example, under financial materiality, a company might consider how more stringent sustainability regulations like mandatory transition planning might impact on its profitability or they might think about the financial implications of having facilities in certain areas of the world that could be damaged or disrupted by flooding or other climate-related issues, both now and in the future.

Meanwhile under impact materiality, a company might assess how their manufacturing processes are contributing to air pollution or how suppliers in their value chain might be violating human rights by underpaying staff and employing children.

Unlike other sustainability regulations and standards (e.g. TCFD, ISSB) which only require a financial materiality assessment, CSRD requires assessment of both financial and impact materiality. If a topic is either financially material or meets the impact materiality threshold (or if it meets both), the company will be required to report on that topic under CSRD.

It’s also worth emphasising that companies need to consider not just their direct operations but all elements of their up-and-downstream operations including the suppliers in their value chain.

The CSRD does not mandate how a company should conduct its materiality assessment, but we expect some organisations will choose to use existing frameworks such as SASB or the Global Reporting Initiative (GRI).

The DMA itself requires the assessment of impacts, risks and opportunities (IROs) to a company, which in turn will require them to engage their suppliers and stakeholders via surveys, reviews of existing data and analysis of other inputs such as media, peer analysis and third-party research.

This element of CSRD is likely to be challenging and time consuming for many companies, which is why getting started as soon as possible is advised.

ESRS reporting standards

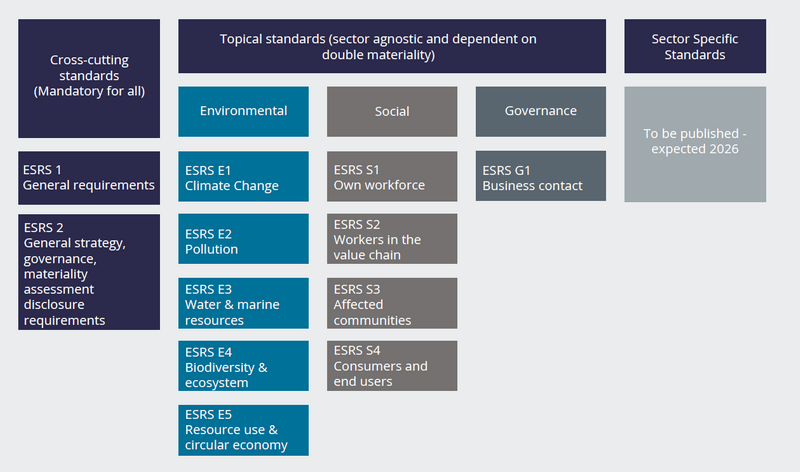

The CSRD utilises the European Sustainability Reporting Standards, a set of mandatory sustainability topics using a standardised format and prescribed content.

All in scope companies must follow guidance provided in ESRS and report on ESRS 2 which contains disclosures on general requirements as well as strategy, governance and the outcomes of the materiality assessment.

The double materiality assessment is used to determine which of the 10 E, S & G topical standards a company must report against. Each topic contains numerous sub-disclosures.

For example, under the Environmental pillar, ESRS E1 (Climate Change) includes disclosures on transition plans, climate change policies, actions and resources, adaptation and mitigation targets, energy consumption, greenhouse gas emissions, GHG removals and mitigation, internal carbon pricing, and the financial impacts of climate impacts, risks and opportunities. This is just one of the topics covered by the ESRSs.

Sector specific standards are also coming and will be applicable to specific business sectors. These are expected to be published in 2026. They will be mandatory for any company within that sector and not subject to a materiality assessment.

Data collection and gap analysis

Collecting data is another essential element of preparing for CSRD reporting.

Once a company has completed its double materiality assessment, they will then need to begin gathering the data to complete the required disclosures under the ESRS.

Each ESRS has a range of associated reporting elements, with their own required disclosures. There may be thousands of data points required.

Alongside this, companies will need to start identifying any gaps in the data and thinking about how they will fill them prior to reporting.

Whilst collecting the data, companies will need to think about the data’s validity, relevance, accuracy and reliability. Furthermore, the data collection process must be fully documented for assurance purposes later in the process.

Tagging and reporting

A company’s CSRD report must be included as a dedicated section in their annual management report.

This ‘sustainability statement’ comprises four parts including a general section, and information on the three ESG areas: Environmental, Social and Governance.

Within the statement, companies will need to report on their sustainability impacts, risks and opportunities, as well as the metrics and targets they are using, and any sector or entity specific information relevant to the ESRS standards.

The statement also needs to both human and machine-readable; tagged using the XBRL Taxonomy – a digital categorisation system aligned with the ESRS.

Assurance

To comply with the CSRD, companies will need to get their sustainability information assured by an independent external auditor (e.g. PwC, Deloitte etc.).

In the first year of CSRD disclosure, companies will need to provide ‘limited’ assurance over the reliability and accuracy of their information. Potentially this could shift towards ‘reasonable’ assurance over time and under certain conditions.

As assurance needs to be done externally and by an accredited provider i.e. a statutory or financial auditor, companies should allow additional time (and budget) to complete the process. The resulting assurance report also needs to be publicly disclosed alongside the company’s annual financial report.

Summary

As you can see there is a lot to do to comply with CSRD.

Many large companies will need to report on their 2025 sustainability data, meaning they’ll need to complete the DMA process and establish processes to collect data as soon as possible.

For those with processes already in place, they’ll need to ensure the information they collect aligns with CSRD before conducting their DMA.

All this means there is a significant resource burden on companies needing to comply with CSRD.

So where should you begin?

Our advice is don’t delay! Find out if you or your portfolio companies are in scope, start to look at the requirements and get a plan in place for the next 1-2 years.

If you’d like to find out more about CSRD and how Danesmead ESG can help, please get in touch at [email protected] or visit danesmeadesg.com/csrd.