Beyond the siloed tech stack: How applied AI will dramatically alter fund administrator selection for fund managers

By Skyler Steinke, DwellFi

Published: 18 November 2024

Things are about to shift in the fund industry as the role of applied AI (i.e., generative AI applied to real world use-cases) has become increasingly pivotal. Traditionally, fund managers have faced significant challenges when selecting a fund administrator, primarily due to the siloed nature of technology stacks within these organisations. This fragmentation often results in inefficiencies and a lack of integration, which can hinder the overall performance and responsiveness of fund administrators. However, the advent of AI and applied AI is set to transform this paradigm, offering a more holistic approach to data management and operational efficiency.

The traditional challenges

Historically, fund managers have grappled with the limitations imposed by the disparate systems used by fund administrators. These siloed technology platforms often lead to a lack of integration, making it difficult for fund managers to access and analyse data seamlessly. This fragmentation not only slows down processes but also impacts the quality of client service, as fund administrators struggle to deliver timely and accurate information.

Moreover, the manual processes inherent in these traditional systems have been a constant source of frustration for fund managers. The need for manual interventions and the slow responsiveness of fund administrators have long been pain points in the industry. As a result, fund managers have often found themselves outgrowing their fund administrators, necessitating a switch to more capable service providers as their needs evolve.

The AI revolution

Enter AI and applied AI, which are poised to revolutionise the way fund administrators operate. By applying AI holistically across their technology platforms, fund administrators can unify their data, breaking down the silos that have traditionally hindered their performance. This integration allows for more efficient data management, enabling fund managers to access the information they need in real-time, regardless of its format or origin.

AI’s ability to parse through structured and unstructured data, such as PDFs, documents, and spreadsheets, means that fund administrators can now offer a level of service that was previously unattainable. This capability not only enhances the client service experience but also allows fund administrators to scale their operations more effectively, taking on more clients without compromising on quality.

Empowering fund managers with future-proof choices

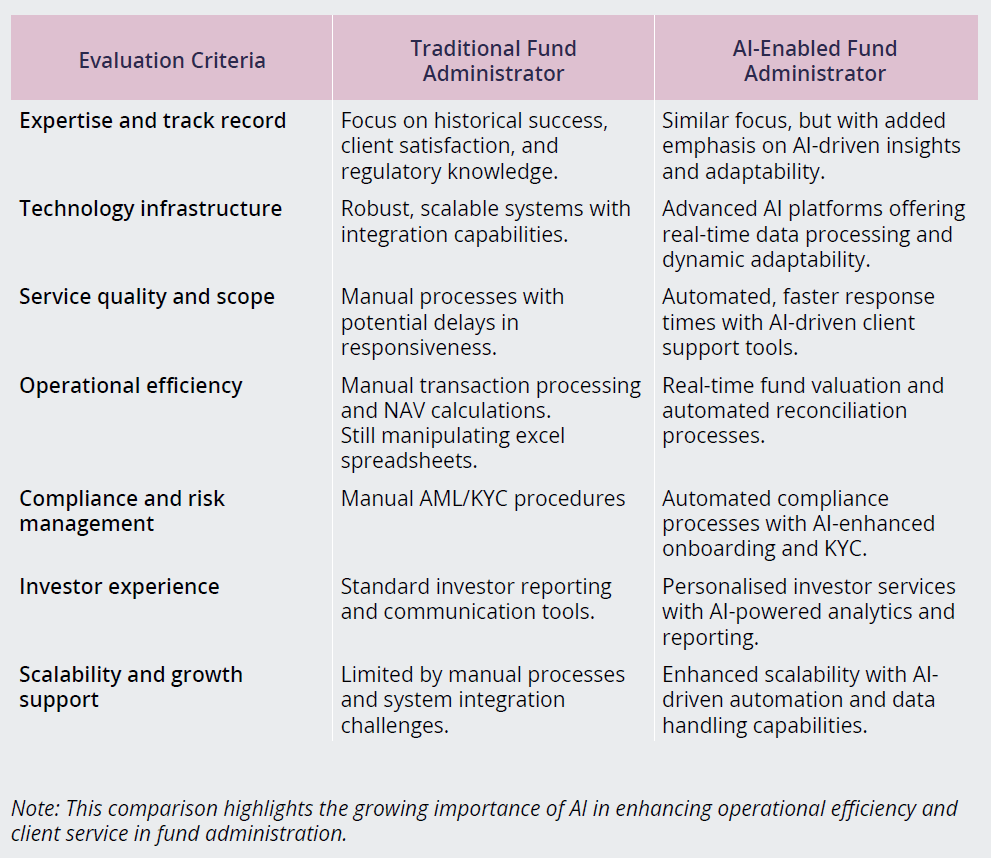

Given these advancements, it is imperative for fund managers to approach vendor due diligence with a new perspective. The focus should now be on identifying fund administrators who have embraced AI as a core component of their operations. An AI-first fund administrator is not just a service provider; they are a strategic partner capable of growing alongside the fund manager, adapting to their evolving needs without the risk of being outgrown.

By selecting a fund administrator who has integrated AI into their processes, fund managers can ensure a more seamless and efficient service. The ability to deliver bespoke reporting, faster turnaround times, and enhanced data analytics are just a few of the benefits that an AI-driven fund administrator can offer. This empowers fund managers to make future-proof choices, ensuring that their service provider can scale with them as their needs grow.

Competitive advantage and operational efficiency

AI enables fund administrators to automate repetitive manual tasks such as data entry, reconciliation, and report generation. This reduces the need for human intervention to more of a review process, allowing firms to process higher volumes of work at lower costs, while still keeping the human in the loop. As a result, fund administrators can handle more clients and products with the same resources, leading to increased capacity, better scalability, and higher profitability.

Moreover, AI-driven analytics provide deeper insights into fund performance and market conditions, enabling fund administrators to offer personalised services that cater to specific GP/LP fund client needs. In addition, fund administrators are constantly looking in the rear-view mirror and often on a quarter or more lag, when forecasting or analysing their internal business or existing client base. The ability to monitor their business in near real time, allows the fund administrator to make decisions faster, monitor service level agreements (SLA’s) and do real-time fund client and competitor due diligence at scale. This opens up new revenue streams and enhances client satisfaction and retention.

Conclusion

In conclusion, the integration of AI into fund administration is not just a technological upgrade; it is a fundamental shift in how these services are delivered. By selecting a fund administrator who has embraced AI, fund managers can ensure that they are partnering with an organisation that is equipped to meet their needs both now and in the future. The days of siloed technology stacks and manual processes are numbered, and the future of fund administration is undoubtedly AI-driven. As fund managers embark on their due diligence journey, the choice is clear: select an AI fund administrator and unlock the full potential of your operations, ensuring a partnership that will not be outgrown.