Arbitrage for improving the performance of fixed income portfolios

By Julian Klymochko, Accelerate

Published: 19 June 2023

Warren Buffett once said, “Give a man a fish and you will feed him for a day. Teach a man to arbitrage and you will feed him forever.”

While arbitrage has been a long-time favourite investment strategy of the world’s greatest investor, it is often overlooked as a fixed income alternative.

Merger arbitrage is an investment strategy that involves buying securities of companies involved in a merger or acquisition. Arbitrage aims to profit from the price difference, or ‘spread’, between the current market price of an M&A target company’s stock and the expected acquisition price.

When a merger or acquisition is announced, the stock price of the target company often rises, but it may not immediately reach the acquisition price. Arbitrageurs take advantage of this price differential by buying the stock of the target company at the current market price and then selling it at the expected acquisition price once the deal is completed.

A simple example: Vandelay Industries announces the acquisition of Acme Corporation for US$100 per share, closing in 6 months. An arbitrageur buys Acme Corporation stock for US$95 per share and holds the stock until the deal closes. Upon closing, the arbitrageur receives US$100 for an approximate 5% return in six months for a 10% arbitrage yield (annualised return).

If buying at 95 and receiving 100 upon maturity reminds you of a zero-coupon bond trade, you would be right. Arbitrage is fixed income investing in disguise.

The arbitrage yield earned from an arbitrage investment in analogous to a bond yield earned from a bond investment.

However, arbitrage features several key differences compared to bonds as a fixed income alternative:

- Investment return - Historically, arbitrage has generated higher returns than the global bond index and with lower volatility.

- Duration - Arbitrage has a significantly lower duration, measured in months, compared to bonds’ duration, which is typically measured in years.

- Tax-efficiency – Arbitrage generates yield via capital gains, which can be more tax efficient for certain investors compared to interest income from bonds.

The past several years have been challenging for fixed income investors. Bonds have been nearly a pure-play bet on the direction of interest rates. Accordingly, when interest rates rose, bonds produced poor results for investors.

Arbitrage is a fixed income alternative investment strategy that, given its lower duration and higher expected returns, can do well in a rising rate environment.

A common Wall Street maxim is that diversification is the only free lunch in investing.

Diversification is not just for stock portfolios. Diversifying a bond portfolio can work wonders for fixed income investors.

For example, adding arbitrage to a bond portfolio can increase return while reducing risk and improving tax efficiency.

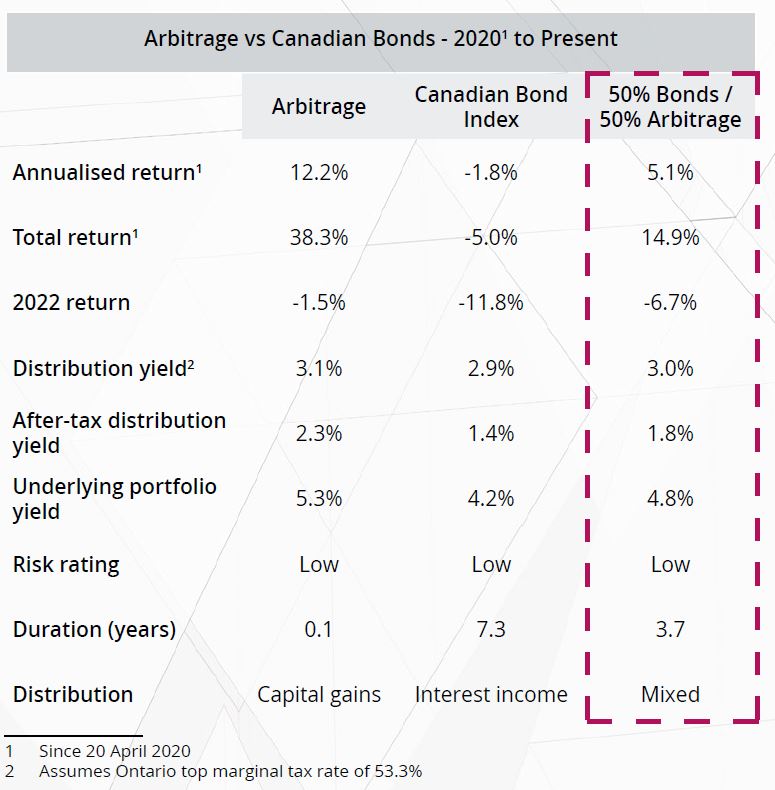

Over the past three years¹, the Canadian bond index has struggled, losing -1.8% per year. If a bond investor were to complement their bond portfolio with half allocated to arbitrage, that -1.8% annual loss would turn into a +5.1% annual gain. Adding arbitrage to a bond portfolio improved the return by 6.9% annually since 2020.

In addition, adding arbitrage to a bond portfolio increased its pre-tax and after-tax yield.

Many people wonder, have they missed the opportunity in arbitrage? Can it still benefit a fixed income portfolio now that bond yields are more attractive?

While a protracted decline in interest rates would tip the scale in favour of long-duration bonds, the key tenet of diversification is to provide the highest return with the least amount of risk. Therefore, it is prudent to spread ones’ bets to account for any scenario. A diversified investor should have a well-performing portfolio whether rates go up or down.

Nonetheless, investors have not missed the boat on arbitrage. It still offers a higher underlying yield compared to the Canadian bond index. For example, a 50% allocation to arbitrage would boost a bond portfolio’s underlying yield from 4.2% to 4.8%.

Free lunch or not, it is time that investors diversify their fixed income portfolios for higher potential returns with lower expected risk through arbitrage. Nevertheless, don’t take my word for it – listen to the Oracle of Omaha.